Digital nomad insurance isn’t usually the first thing on our minds when planning our nomad travel adventures.

However, should the worst happen far away from home and loved ones, a digital nomad health insurance policy could make all the difference at a time of extreme stress and worry.

We look at three of the leading digital nomad health insurance policies on the market from SafetyWing, World Nomads and Genki World to help you choose the best one for you.

Digital nomad insurance could end up being your best friend at a critical time

While nobody wants to think of the worst, the fact is things can happen while travelling.

I am pleased and relieved to say that I’ve been very lucky in my travels however I wanted to share a personal story very close to me that demonstrates just how critical travel and health insurance can be when the worst happens

Many years ago my younger sister was on a holiday in Spain with her then-boyfriend, both of them were in their early 20s.

While on holiday, my sister was hit by a car on a busy road as she was crossing the road. She was looking in the wrong direction and stepped directly in front of a car travelling at quite some speed.

I’ll spare the gory details but suffice to say it was a serious road accident.

She was travelling without travel or private health insurance!

The moment we found out I took the first flight to Spain from the UK to be by her side.

From then on, it was a long and difficult journey, dealing with the hospitals (who were great by the way) and eventually paying for an expensive medical repatriation flight from Spain to the UK as she wasn’t in a position to fly back sitting down due to a serious back injury.

I am very pleased to say that my sister was incredibly lucky and is alive and well today.

In the above example, we had to pay a lot of expenses that could have been covered had she have taken out a travel insurance policy.

This is not a sales pitch for nomad insurance, it’s a true story and I hope it is a reminder that while travel insurance can seem boring and a waste of money, it’s times like when my sister had her road accident that it can make all the difference.

We recently reported on Methanol poisoning in Laos that took 6 lives

This avoidable Methanol poisoning incident in Laos, Southeast Asia is another reminder of the need for digital nomad insurance as while unlikely, accidents can happen and at times like these, it’s a relief to have the resources and support provided by health insurance providers.

The reason we recently shared these stories is to bring awareness and hope that our fellow digital nomads can travel with peace of mind and be well-prepared should the worst happen.

We reviewed three of the most popular digital nomad health insurance policies on the market to help you choose the best cover for your nomad travels

As insurance policies are complex by nature we have provided a short summary review of each of the digital nomad health insurance providers along with the key benefits and limitations of each so you can get a quick idea.

To get more detailed and up to date info on the policies and a personalised insurance quotation there is a button to take you to the official websites.

Calculate your digital nomad insurance cover from SafetyWing

Calculate your digital nomad insurance cover from Genki World

What are insurance claims experiences like with SafetyWing, Genki World and World Nomads?

Insurance as we all know is a product that we don’t ever want to use. But, if the situation arises when we need it, it’s usually of high importance and the time we need the insurance company to step up, be responsive and provide the help needed.

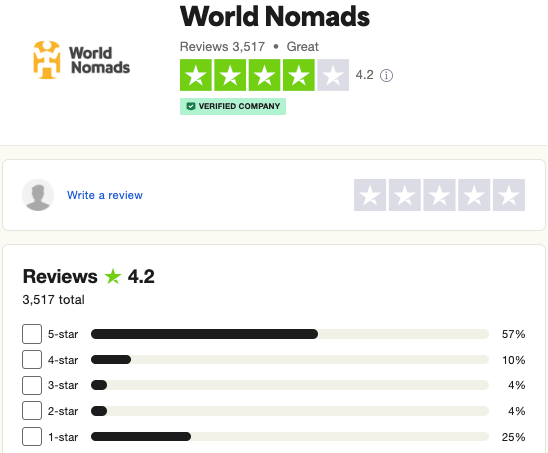

It’s very difficult to accurately know what the claims experiences for SafetyWing, Genki World and World Nomads customers are so we have provided screenshots and links to Trustpilot to give some indication of customer satisfaction,

We never recommend any products or services with less than 4 / 5 in reviews. SafetyWing just made it with 4 out of 5 on Trustpilot, Genki World did best with 4.4/5 and World Nomads 4.2/5

If you would like to get an idea of claims experiences with the digital nomad health insurance providers we have featured we’d recommend checking out the reviews.

You should keep in mind that very often, satisfied customers rarely leave reviews, but disgruntled customers do. So reviews are probably not fully reflective but can provide a little bit of insight before deciding on which nomad travel insurance policy to opt for.

If you have any digital nomad insurance experiences you would like to share, please feel free to do so in our comments section at the bottom of the page.

SafetyWing has a Good rating on Trustpilot with 4 out of 5 (1510 reviews in December 2024)

Genki World has an Excellent rating on Trustpilot with 4.4 out of 5 (571 reviews in December 2024)

World Nomads has a Good rating on Trustpilot with 4.2 out of 5 (3517 reviews in December 2024)

Frequently Asked Questions (FAQ)

What is nomad nomad insurance?

Nomad insurance is a blend of travel and health insurance designed for remote workers and long-term travellers, covering medical emergencies, trip disruptions, and sometimes personal belongings.

What isn't typically covered by digital nomad insurance?

Standard exclusions may include pre-existing conditions, extreme sports, and high-risk countries.

What should I know before choosing a policy?

Consider your travel style, planned activities, and any existing health conditions. Ensure your destinations and specific needs (like adventure sports) are covered.

Are there age restrictions?

Most providers have age caps (SafetyWing: 69, World Nomads: 70), but Genki World has no age restrictions

What if I have a pre-existing illness?

World Nomads and Genki offer limited or specific coverage, while SafetyWing typically does not.

Are extreme sports usually covered?

World Nomads excels in this area, covering a wide array of adventurous activities, while SafetyWing and Genki World offer limited or no extreme sports coverage.

Is equipment covered against damage or theft?

Yes, but coverage limits and conditions vary. World Nomads provides more comprehensive protection for gear than the others. SafetyWing can offer equipment cover for an extra monthly fee.

Can digital nomad insurance help if I lose my passport or wallet?

Yes, most providers assist with emergency documentation and financial support in such cases but it’s important to check the policy yourself to be sure.

What’s the conclusion on digital nomad health insurance?

While digital nomad health insurance might seem like an unnecessary expense, it could be invaluable should the worst happen.

In summary:

SafetyWing is ideal for budget-conscious nomads seeking flexible coverage.

World Nomads excels for adventurers needing comprehensive coverage for extreme sports.

Genki World stands out for fast claims processing and tailored plans for both short and long-term travellers.

If you have any thoughts or experiences on digital nomad health or travel insurance please feel free to share them in our comments section at the bottom of the page.

Ultimately, your choice will depend on your travel habits, budget, and risk tolerance. Take time to compare and select the right policy, ensuring you’re protected wherever your nomadic journey takes you.

We’ve provided the information to the best of our knowledge. Please do ensure that you check the digital nomad health policies yourself to make sure that they are suitable for your travel and lifestyle needs.

We wish you happy and healthy travels!