The world today is more interconnected than ever before presenting unprecedented opportunities for a more ‘globally optimised’ lifestyle.

With rapid advancements in technology, travel, and communications, it is increasingly possible for individuals to live as global citizens, simultaneously enjoying the many benefits of multiple jurisdictions.

Long gone are the days when you had to be geographically stuck down to one place so to speak.

With a bit of clever planning and flexibility on your part, you can navigate the world, its systems and regulations in a way that can ultimately benefit you and provide greater freedom and security.

One such strategic approach to living as a global citizen is known as the 5 Flag Theory or 5 Flags to Freedom.

The five flag theory presents a framework for maximising personal freedom, financial security, and global mobility by leveraging different countries for specific advantages.

This article will explore the origins of the 5 Flag Theory, how it has evolved, and how adopting it could enable you to travel and live a little more smartly across the globe.

The Origins and History of the 5 Flag Theory

The concept of Flag Theory was first articulated in the 1980s by Harry D. Schultz, a famous American investor and financial journalist.

Harry D. Schultz initially referred to it as the Three Flag Theory, which encouraged people to spread their lives, assets, and citizenships across multiple countries to take advantage of the best that each location had to offer.

Schultz’s idea was grounded in the belief that no single government should have complete control over an individual’s wealth, freedom, or rights.

By planting flags (a metaphor for establishing a presence) in different countries, individuals could reduce their exposure to the risks associated with being bound to one single nation, such as high taxes, currency devaluation, or political instability.

The old adage of not having all one’s eggs in one basket certainly comes to mind here.

Over time, Schultz’s original idea evolved into the 5 Flag Theory, as the global environment became more complex.

The additional flags provided further diversification for individuals seeking global lifestyles, financial freedom, and reduced tax burdens.

In essence, the 5 flag theory provides a strategic roadmap for global citizens to optimise their lives and minimise government interference by favourably and “legally arbitraging” between various national jurisdictions.

It’s important to highlight this, we are talking about legal arbitrage here, making the most of each country’s systems to your advantage and yet being firmly within the law.

Tim Ferriss alluded to much of this in his now-famous book, the 4-hour work week where he spoke about living in countries with a low cost of living while earning money in high-value countries remotely.

It’s almost a precursor to the boom in remote working and the digital nomad movement we are seeing today.

The Five Flags to Freedom and Smart Global Living

Flag 1 – Citizenships and passports

The first flag involves obtaining citizenship or residency in a country that offers freedom of movement and favourable diplomatic relations.

This flag ensures that you have a “home base” or a nationality that allows easy travel around the world. Ideally, this should be a country with strong passports (visa-free travel to many countries) and one that doesn’t heavily tax non-residents or impose restrictions on expatriates.

Citizens of countries like Singapore, Spain, Portugal, Malta, or St. Kitts and Nevis often enjoy significant travel privileges.

Portugal for example, offers a Non Habitual Resident (NHR) program with significant tax advantages for certain high-value professions and also a Golden Visa program which allows for a pathway to Portuguese citizenship via investments.

The Portuguese passport is considered to be the 4th strongest in the world offering visa-free travel to 191 out of 227 countries. Singapore offers slightly more with 195 countries in which you can travel visa-free.

There have been changes to the Portuguese NHR and Golden Visa programs in recent years but they are still available if perhaps not as generous or as easy to obtain as before.

Flag 2 – Legal Residency

The second flag focuses on legal residency in a country where you spend time, one that does not impose income taxes on overseas income for residents and ideally no to low income tax.

Many global citizens choose tax havens like Monaco, Dubai, or Panama, where there are no income taxes or significantly lower tax rates.

Dubai is an increasingly popular place for tax residency with its zero-income tax policy.

You would need to live in Dubai for at least 183 days or half of the year to claim tax residence in Dubai. There are some other options but are out of the scope of this article.

Italy offers a tax incentive to high net worth individuals with a flat €200,000 fixed rate of tax every year irrespective of global income. This was €100,000 previously but was recently increased to €200,000.

Some ultra-high-net-worth individuals could be spending close to that amount of money on accountants and tax specialists and perhaps a lot more in taxes already, so a fixed rate tax of €200,000 could be appealing alongside the obvious benefits of living in a country like Italy with its rich culture, beauty and culinary scene,

A favourable legal residency can allow individuals to live in countries with high standards of living while minimising their tax burden.

Flag 3 – Business Base

The third flag pertains to incorporating your business in a country that offers favourable corporate tax laws, business-friendly regulations, and legal protections.

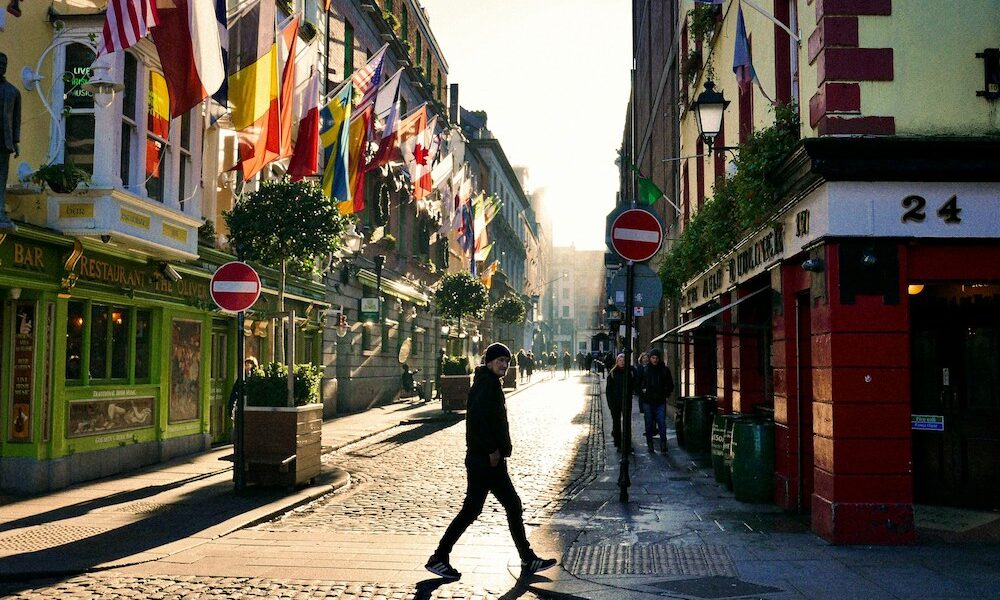

Jurisdictions such as Singapore, Hong Kong, Estonia or Ireland are often popular choices as a business base because of their stable economies, relatively low tax rates, and strong protections for businesses.

Establishing a company in one of these countries allows entrepreneurs to reduce tax liabilities and benefit from efficient regulatory frameworks.

Flag 4 – Asset Protection

The fourth flag involves placing your wealth in a secure and stable jurisdiction with robust banking systems and privacy laws. Asset protection is critical in today’s volatile economic environment.

Many choose to bank or hold assets in Switzerland, the Cayman Islands, or Liechtenstein, where banking privacy is strong and government intervention is minimal. Diversifying wealth geographically can protect you from political risks, currency instability, and excessive taxation.

Flag 5 – Lifestyle Base

The fifth and final flag focuses on establishing a lifestyle base, or ‘playground’, in a country that offers an enjoyable lifestyle, a favourable climate, and a good quality of life.

This is where you spend your free time, vacation, or live part of the year. Countries like Portugal, Spain, Thailand, or Italy are often chosen for this flag, as they provide a relaxed lifestyle, rich cultures, and inspiring environments in which to enjoy life.

The key is finding a location that resonates with your personal interests and lifestyle preferences. It’s not one size fits all.

The Evolution of the 5 Flag Theory and Modern Adaptations like Digital Nomads and Online Entrepreneurs

While the original 5 Flag Theory was largely designed for the wealthy elite, in today’s globalised world, it has become more accessible to a wider range of people.

The rise of digital nomadism, cryptocurrency, and remote work has allowed more individuals to participate in a global lifestyle.

In recent years, many governments have introduced “digital nomad visas” that cater to remote workers, allowing them to live in low-tax countries while earning income abroad.

Additionally, second citizenship programs (such as the Citizenship by Investment programs offered by various Caribbean and European nations) have made it easier for individuals to obtain multiple passports and increase their global mobility.

Offshore banking and international investment are also much easier today due to technology, giving individuals more options for storing wealth in secure, tax-friendly jurisdictions.

The Key Benefits of the 5 Flag Theory

When implemented correctly, the 5 Flag Theory offers several strategic benefits for the global citizen:

Tax Optimisation: By establishing residency and business operations in lower-tax or no-tax jurisdictions, individuals can significantly reduce their overall tax burden. Taxation is of course a very complex matter and the goalposts are constantly moving! With proper advice it’s possible to optimise tax exposure within internationally accepted legal frameworks.

Asset Protection: Diversifying wealth across several countries helps mitigate risks associated with political instability, economic downturns, or government seizures.

Your assets are less vulnerable when spread across multiple jurisdictions.

Enhanced Mobility: By holding passports from countries with favourable visa policies such as Singapore, the UK, the US, Portugal and Spain to name a few, you gain increased freedom of movement.

This allows for spontaneous travel and less hassle when moving between different regions of the world.

Legal Freedom: Different countries offer varying levels of personal freedoms.

By choosing countries with favourable legal environments, individuals can enjoy higher levels of privacy, freedom of speech, and autonomy.

Quality of Life: The five flag theory allows individuals to select lifestyle bases that suit their personal preferences, from tropical paradises to cultural hubs and everything between.

The 5 flag lifestyle can give you the flexibility to live in places that align with your values and aspirations, provide plenty of variety and enjoy the best weather all year round if you so desire.

A fictional example of the 5 flags theory: Meet David, an online entrepreneur and digital nomad

David is a 35-year-old digital nomad and online entrepreneur from the UK who uses the 5-flag theory to optimise his lifestyle, reduce taxes, and protect his assets while maintaining the flexibility and freedom of true global living.

Here’s how David uses the 5-flag strategy:

Tax Residency (Flag 1: Dubai)

David sets up his primary tax residency in Dubai, UAE, a popular jurisdiction due to its zero-income tax policy.

Since Dubai has no personal income tax and requires a minimum stay of 183 days per year for tax residency, David ensures he spends at least half the year in Dubai. He spends this time during European winters when the weather in Dubai is more pleasant than back home in England.

This allows him to legally minimize his tax obligations while enjoying a cosmopolitan lifestyle with fellow expats and digital nomads in a safe and business-friendly environment.

Citizenship (Flag 2: United Kingdom)

David holds citizenship in the United Kingdom which provides him with visa-free travel to over 177 countries.

This gives David the freedom to travel easily for both business and leisure, without the hassle of constantly applying for visas.

Business Incorporation (Flag 3: Estonia)

For his online businesses, David has incorporated in Estonia under its e-Residency program.

Estonia’s transparent legal system, low corporate tax rates, and easy digital management of businesses make it ideal for Alex’s global business operations.

He manages his company remotely, enjoying the benefits of low administrative burdens and relatively favourable tax treatment on retained profits.

Asset Protection (Flag 4: Switzerland)

To protect his growing wealth, David holds his savings and investment portfolios in a Swiss bank account.

Switzerland has always been known for its financial stability, strong asset protection laws, and banking privacy.

While banking privacy is perhaps not as robust as it once was due to growing international and political pressure, Switzerland is still a very safe place to bank due to its neutrality, solid banking infrastructure and capital requirements.

No matter what happens around the world, the money in Switzerland should still be there when you need it.

Holding savings and investments in Switzerland can help to ensure that David’s financial assets are safe from political or economic instability in other countries where he may travel or live part-time.

Playgrounds (Flag 5: Bali, Indonesia)

When David isn’t in Dubai fulfilling his tax residency requirements, he spends some of his time in Bali, Indonesia.

Bali offers a vibrant expatriate community, affordable living, and a laid-back lifestyle that balances work and relaxation.

While Bali isn’t his tax residency, it serves as a perfect playground for David to recharge, meet like-minded digital nomads and enjoy his freedom as a Global Circler.

This fictional example demonstrates how David strategically places different aspects of his life across multiple jurisdictions using the 5-flag theory.

By leveraging Dubai for his personal tax residency, his strong UK passport for extensive visa free travel, and the benefits of other countries for business, banking, and lifestyle, David enjoys a flexible and tax-efficient global lifestyle.

Five Flags Theory Challenges and Considerations

While the 5 Flag Theory can provide significant advantages, it is not without its challenges.

Navigating the legal systems of multiple countries can be complex, and careful planning is required to ensure compliance with tax laws and residency requirements.

Additionally, acquiring multiple residencies or passports may require significant financial investment, and managing assets across various jurisdictions can become logistically demanding.

All the while, regulations are changing so what worked yesterday may not work today or tomorrow.

Moreover, global political and economic trends can impact the stability and attractiveness of certain flags.

For example, banking regulations in tax havens have tightened in recent years due to international pressure, making it harder for individuals to maintain full banking privacy. There is no sign this will slow down but rather get even tighter.

Lastly, and very importantly, those with families, elderly dependents or close ties with friends and extended family will certainly have to sacrifice time with loved ones as a result of living far away for extended periods of time.

This for many could be too high a price to pay for the freedoms that the 5 flag theory can bring.

Conclusion

The 5 Flags Theory presents a compelling model for those looking to live globally, optimise their finances, and maximise their personal freedom.

By strategically selecting countries for different aspects of life such as citizenship, residency, business, banking, and lifestyle, global citizens can reduce their exposure to risks and benefit from the best that the world has to offer.

While this approach will certainly require careful planning and a significant investment in time and resources, the five flag theory can open the door to a life of increased mobility, legal protection, and financial freedom.

For those willing to embrace the complexities of international living, the 5 Flag Theory offers a smart and efficient way to travel, live, and thrive across the world as a true global citizen.

Disclaimer: Please note that we are not providing legal or tax advice here. We are simply illustrating the concept of the 5 flags theory and how it could be utilised effectively by global citizens to optimise their international lifestyles